Let’s get a grip on your outflow!

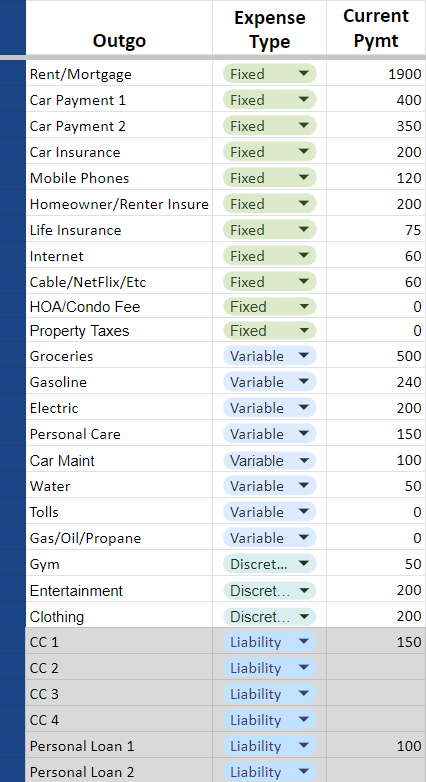

This section helps to identify all the expenses that should be accounted for in your monthly budget. The image to the right shows a solid representation of typical expenses found in a budget.

Click here to access the full Google Sheets worksheet.

There are three types of expenses plus liabilities:

- 1) Fixed Expenses – expenses that don’t change month-to-month

- Rent/Mortgage

- Vehicle Payments

- Personal Loans

- 2) Variable Expenses – expenses that are changing from month-to-month

- Utility Bills

- Gasoline

- Groceries

- Personal Care

- 3) Discretionary Expenses – these can be fixed or variable and are not necessities.

- Cable/Netflix

- Gym Membership

- Entertainment

- Clothing

- Liability – these items represent a category of debt that needs to be repaid. These items will be replicated in the Net Worth worksheet at a summary level.

This is one breakdown scenario. Everyone will have a different view of discretionary expenses. What is optional for me, like clothing, might be a variable variable expense for you.

One of the big budget busters in today’s economy is subscriptions.

Getting a handle on them can be challenging, especially if purchased through your phone. Frankly, they are often overlooked. If you take advantage of a tool like the Rocket Money (formerly TrueBill) app, they will identify your subscriptions and for many will allow you to request the subscription to be canceled within the app. They may even request a refund for the latest charge on your behalf!

Expense Review Complete?

Now that you’ve reviewed your expenses, were there any surprises? Were you spending more or less than you thought?

Did you find any opportunities to cut wasteful spending? Now, one might argue that this is a scarcity mindset comment, but it comes down to this: you are missing opportunities to invest your money so it can work for you if you are blindly spending it on anything that is not bringing you value. A Disney+ subscription rarely used, is not a good use of your money.

What’s Next?

We now have the customary monthly inflow and outflow of earnings. Deduct the expenses from the income to see the surplus of monthly income if it is a positive number. If it is a negative number, we have some extra homework, but we will assume a positive number.

The big question is: how much of that surplus are you currently saving for an emergency fund and/or investing in performing assets?

In the next section, we will jump into what to do with that surplus.