What are Bonds?

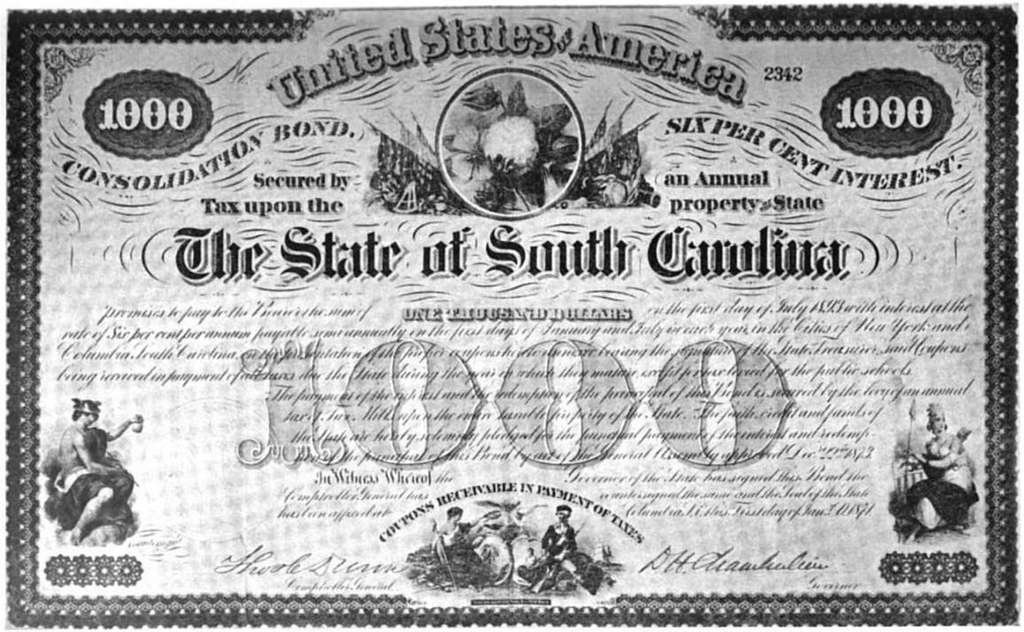

Bonds are debt instruments used by companies and government entities to raise money for operations or projects. As the investor, you loan money to the entity at a specific interest rate and a specific payback date or maturity date. These are considered fixed-income instruments and the interest rate is fixed and better than most savings accounts.

No matter your risk profile and the timeline for using the proceeds of your investments, you will likely want some mix of bonds in your portfolio to diversify and guard against a significant drop in the stock market. The more conservative your approach to investing the higher the percentage of bond investments you will have in your portfolio.

Bonds can be traded on the open market and the prices are driven by supply and demand. It is worthy of note that as bond prices go up, the interest paid goes down. Other factors include the borrower’s creditworthiness (the higher the risk the borrower won’t repay is offset by a higher interest rate earned) and the time until maturity.

Investment Grade Bond Pros & Cons

Pros

- Income generated through Interest Payments

- Stability – the known amount of Income at Maturity

- Profits can be realized if sold at a higher price

Cons

- Lower returns relative to Stock

- Company or Municipality could default

- Bond yields can Fall or not keep pace with inflation

Despite the Cons listed above, the purpose of investing in bonds is to insulate the investor from other investment downturns which can be devastating.

Bond Funds

Not sure where to get started with bonds? You can always check with a certified financial advisor or you can see out bond funds. They can be found as Electronically Traded Funds (ETF) or Mutual Funds. These are professionally managed funds seeking to maximize the return to the investor and charge a fee to manage those Funds. ETFs typically have lower fees associated with them compared to Mutual Funds.

One popular category of funds is the Treasury Inflation-Protected Securities (TIPS) which invest in short-term bonds that track closer to inflation and provide additional security to preserve your capital.

Conclusion

Bonds are debt instruments for companies and governmental agencies to raise money from investors who loan the money to them for a specified period and interest rate.

Bonds play a vital role in portfolios for many investors trying to preserve capital and outpace inflation so they are frequently a larger part of investors as they reach retirement age.